idaho state income tax capital gains

Idaho State Income Tax Forms for Tax Year 2021 Jan. Taxes capital gains as income and the rate is a flat rate of 3.

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Taxes capital gains as income and the rate is a flat rate of 495.

. Of the capital gain net income included in federal taxable income from the sale of Idaho property. The Idaho capital gains deduction may not exceed the capital gain net income included in taxable. To qualify for the Idaho capital gains deduction a taxpayer must report capital gain net income as defined in Section 12229 Internal Revenue Code on his federal income tax return.

Employer Federal Income Tax Withholding Tables 2021 is out now. IDAPA 35 IDAHO STATE TAX COMMISSION Tax Policy Taxpayer Resources Unit 350101 Income Tax Administrative Rules. Only capital gains from the following Idaho property qualify.

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows. Capital gains are.

The purpose of this legislation is to increase the exclusion from 60 to 100 effectively eliminating state assessed capital gains tax on the assets described in the existing. Ad The Leading Online Publisher of National and State-specific Legal Documents. The 2022 state personal income tax brackets are updated from the Idaho and Tax Foundation data.

Your average tax rate is 1198 and your marginal tax. A homeowner with the same home value of 250000 in Twin Falls Twin Falls County would be. Idaho axes capital gains as income.

Idaho Capital Gains Deduction. Days the property was used in Idaho Days the property was used everywhere. Idaho Capital Gains Deduction -- In General Rule 170.

Capital gain net income is the amount left over when you reduce your gains by your losses from selling or exchanging capital assets. A homeowner with a property in Boise worth 250000 would then pay 2003 for their annual property taxes. Taxes capital gains as income and the rate reaches 575.

Idaho tax forms are sourced from the Idaho income tax forms page and are updated on a yearly basis. In Idaho property taxes are set at the county level. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

Take your employees Forms W-4 and determine how much federal income tax needs to be withheld for the 2021 tax year. Idaho axes capital gains as income. Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes.

County tax rates range throughout the state. The combined uppermost federal and state tax rates totaled 294 percent ranking tenth highest in the nation. The land in Utah cost 450000.

1 If an individual taxpayer reports capital gain net income in determining Idaho taxable income eighty percent 80 in taxable year 2001 and sixty percent 60 in taxable years thereafter of the capital gain net income from the sale or exchange of qualified property shall be a deduction in determining. Use the 2021 tables to figure out how much tax you need to withhold from an employees income. A Real property held for at least 12 months.

Capital Gain Net Income Limitation. Taxidahogovindrate For years. 2022 State Capital Gains Rates Income Tax Rates and 1031 Exchange Investment Opportunities for the state of Idaho.

Download or print the 2021 Idaho Idaho Capital Gains Deduction 2021 and other income tax forms from the Idaho State Tax Commission. 100000 gain x 5500001000000 55000. Taxes capital gains as income and the rate reaches 660.

If you make 70000 a year living in the region of Idaho USA you will be taxed 12366. Deduction of capital gains. Toggle navigation 2022 Federal Tax Brackets.

The proposal was outlined in Littles State of the State address and draws from this years 19 billion surplus. The rate reaches 693. The land in Idaho originally cost 550000.

In Idaho the uppermost capital gains tax rate was 74 percent. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

IRS Publication 15-T 2021 Tax Withholding Tables 2021 Download. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. Get Access to the Largest Online Library of Legal Forms for Any State.

Idaho Income Tax Calculator 2021. Idaho state income tax rates range from 0 to 65. For tangible personal property.

The package includes 350 million for a one-time expenditure for tax rebates to most Idaho taxpayers and 251 million in income tax reductions on an annual basis beginning in 2023 for a total of 600 million.

Idaho Tax Forms And Instructions For 2021 Form 40

Idaho State 2022 Taxes Forbes Advisor

Where Upper Middle Class People Are Moving Upper Middle Class Middle Class Financial Advice

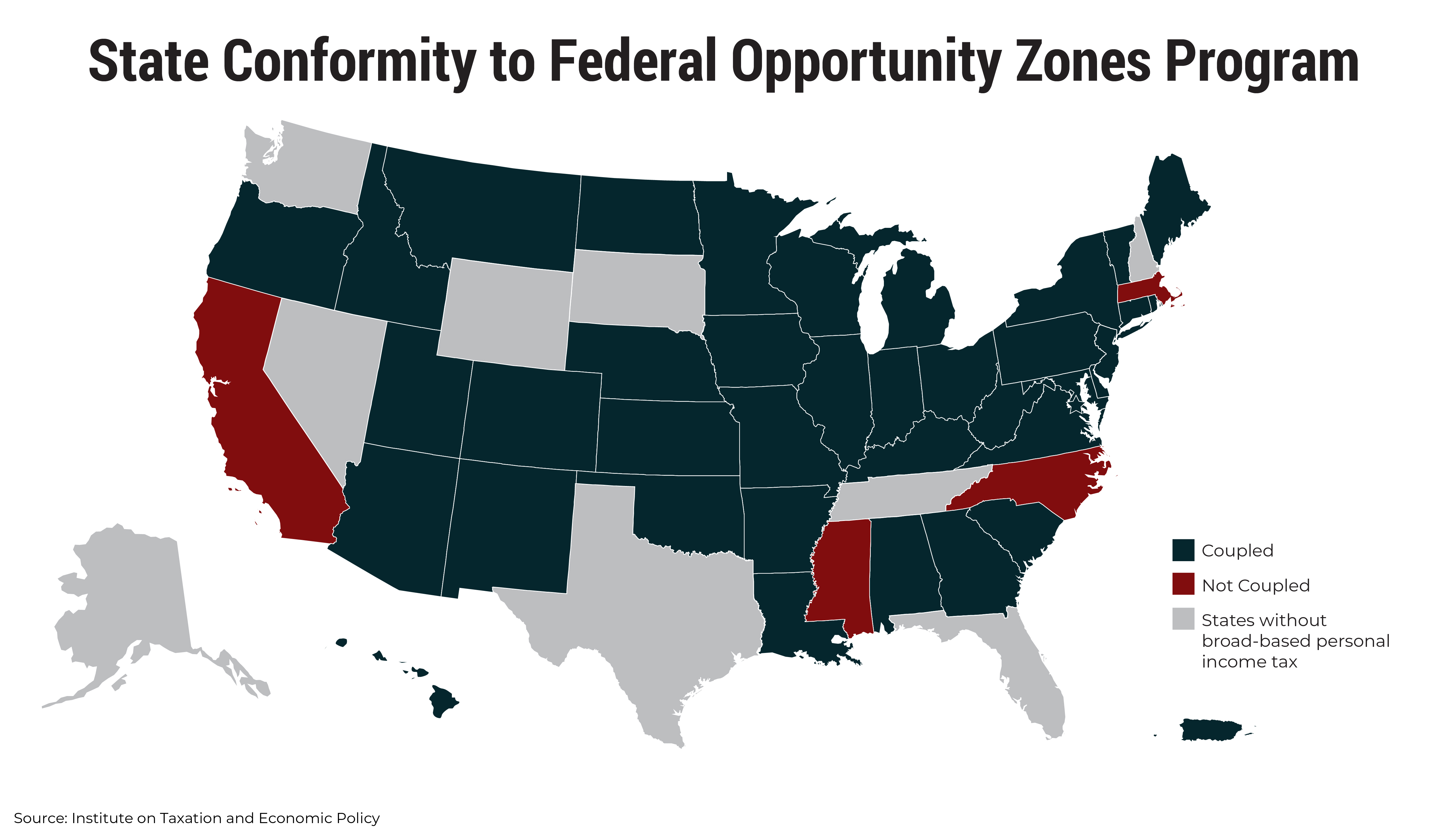

States Should Decouple From Costly Federal Opportunity Zones And Reject Look Alike Programs Itep

2022 State Tax Reform State Tax Relief Rebate Checks

2022 Capital Gains Tax Rates By State Smartasset

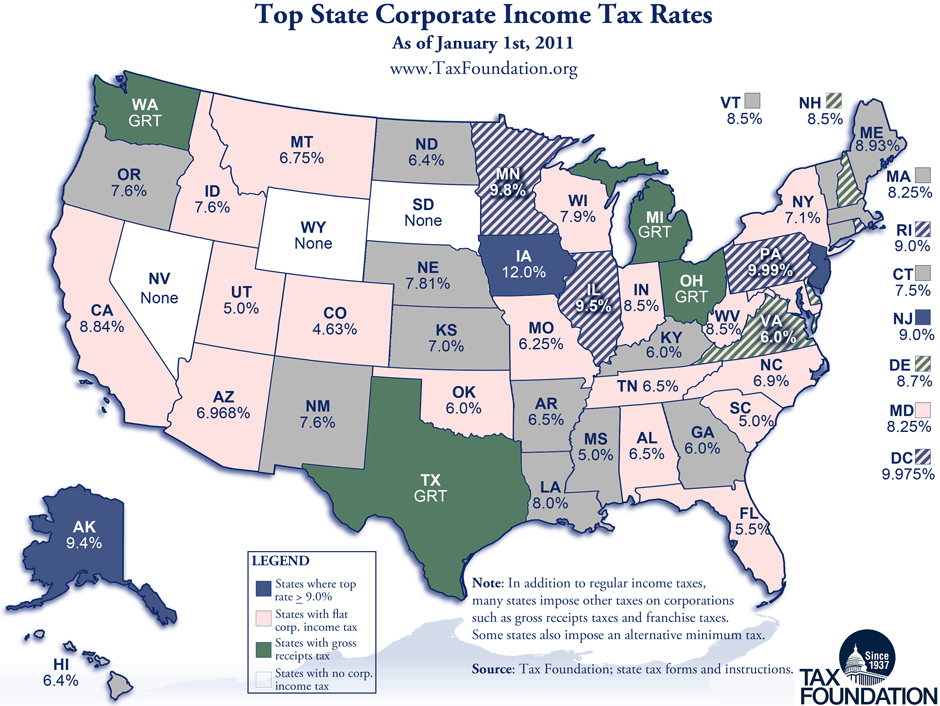

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Capital Gains Tax Rates By State Smartasset

Monday Map State Corporate Income Tax Rates Tax Foundation

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

State Income Tax Rates Highest Lowest 2021 Changes

States With Highest And Lowest Sales Tax Rates

Historical Idaho Tax Policy Information Ballotpedia

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)